The Single Strategy To Use For Custom Private Equity Asset Managers

Wiki Article

Custom Private Equity Asset Managers Fundamentals Explained

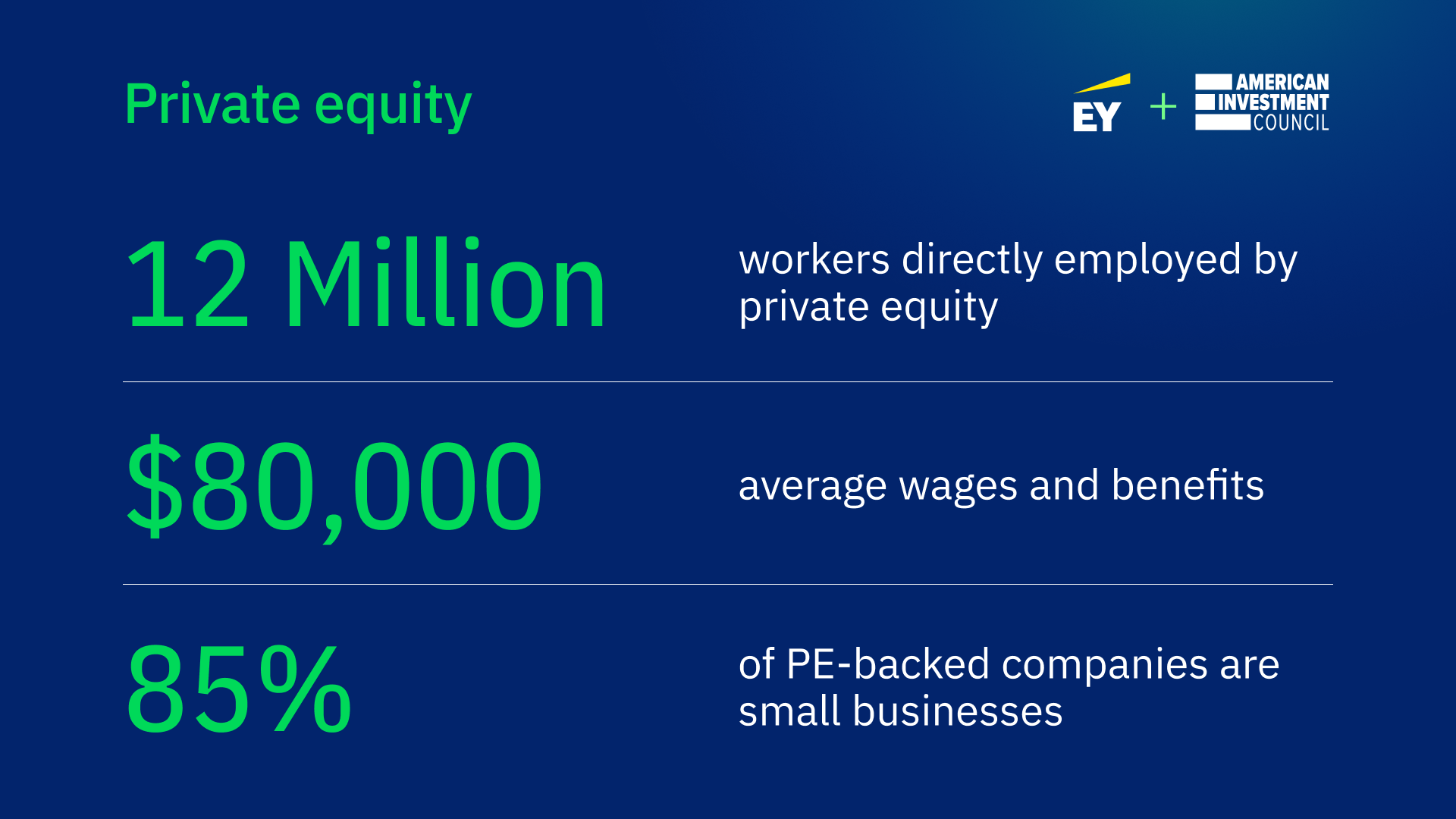

(PE): spending in companies that are not openly traded. Roughly $11 (http://peterjackson.mee.nu/where_i_work#c1942). There may be a couple of points you do not comprehend regarding the sector.

Personal equity firms have a range of financial investment choices.

Due to the fact that the ideal gravitate toward the larger deals, the center market is a dramatically underserved market. There are more sellers than there are extremely experienced and well-positioned financing professionals with substantial buyer networks and resources to manage an offer. The returns of personal equity are typically seen after a few years.

The Ultimate Guide To Custom Private Equity Asset Managers

Traveling below the radar of large multinational firms, most of these small firms often provide higher-quality client service and/or particular niche services Continued and products that are not being supplied by the huge empires (https://www.anyflip.com/homepage/hubrh#About). Such upsides bring in the passion of personal equity firms, as they have the insights and smart to exploit such possibilities and take the firm to the following degree

A lot of managers at profile business are provided equity and incentive compensation frameworks that compensate them for striking their economic targets. Exclusive equity chances are frequently out of reach for individuals who can't spend millions of dollars, but they shouldn't be.

There are policies, such as limits on the accumulation amount of cash and on the number of non-accredited financiers (Private Investment Opportunities).

Custom Private Equity Asset Managers Things To Know Before You Buy

One more downside is the absence of liquidity; once in an exclusive equity transaction, it is not very easy to get out of or offer. With funds under management currently in the trillions, exclusive equity companies have actually ended up being eye-catching financial investment cars for rich individuals and establishments.

For years, the features of exclusive equity have actually made the asset course an eye-catching recommendation for those that can get involved. Since accessibility to exclusive equity is opening as much as more specific investors, the untapped capacity is coming to be a reality. So the concern to take into consideration is: why should you spend? We'll begin with the major debates for purchasing private equity: Exactly how and why private equity returns have actually historically been greater than other properties on a variety of levels, Exactly how including personal equity in a profile impacts the risk-return profile, by assisting to diversify against market and cyclical threat, Then, we will certainly detail some essential considerations and risks for exclusive equity capitalists.

When it comes to introducing a new possession right into a profile, the most fundamental factor to consider is the risk-return account of that asset. Historically, personal equity has shown returns comparable to that of Arising Market Equities and more than all other conventional possession courses. Its reasonably low volatility paired with its high returns makes for a compelling risk-return account.

6 Easy Facts About Custom Private Equity Asset Managers Explained

Private equity fund quartiles have the widest range of returns across all alternative possession courses - as you can see below. Method: Internal rate of return (IRR) spreads calculated for funds within vintage years separately and afterwards averaged out. Median IRR was determined bytaking the average of the mean IRR for funds within each vintage year.

The result of adding private equity right into a portfolio is - as always - reliant on the portfolio itself. A Pantheon research study from 2015 suggested that including exclusive equity in a portfolio of pure public equity can open 3.

On the various other hand, the ideal exclusive equity firms have access to an even larger pool of unknown chances that do not encounter the exact same analysis, in addition to the sources to do due diligence on them and recognize which are worth purchasing (Syndicated Private Equity Opportunities). Spending at the very beginning suggests higher risk, but for the firms that do succeed, the fund take advantage of higher returns

Custom Private Equity Asset Managers for Beginners

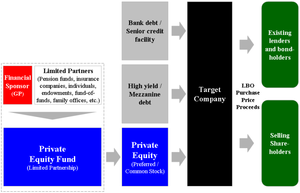

Both public and exclusive equity fund managers commit to spending a percentage of the fund however there stays a well-trodden concern with aligning passions for public equity fund management: the 'principal-agent trouble'. When an investor (the 'primary') works with a public fund manager to take control of their funding (as an 'agent') they hand over control to the supervisor while retaining possession of the assets.

When it comes to exclusive equity, the General Partner doesn't simply earn a management fee. They likewise make a percent of the fund's earnings in the kind of "lug" (typically 20%). This ensures that the interests of the supervisor are straightened with those of the investors. Private equity funds also minimize one more kind of principal-agent trouble.

A public equity investor eventually wants something - for the management to boost the stock rate and/or pay returns. The financier has little to no control over the choice. We showed above exactly how numerous personal equity strategies - particularly majority acquistions - take control of the running of the company, ensuring that the long-term value of the firm precedes, raising the roi over the life of the fund.

Report this wiki page